Криптовалюты

Implement a robust user support system, including live chat, FAQs, and a ticketing system. Encourage users to provide feedback and suggestions to continually improve the interface and user experience http://mastereat.ru/wp-content/pgs/?chto-takoie-ts-upis-v-marafon-razbiraiemsia-biez-slozhnostiei.html.

Fidelity’s platform is characterized by its simplicity and accessibility, which is particularly appealing to those new to trading. The interface is clean and organized, so it’s easy to navigate the wide range of investment options. The platform also features extensive educational resources to help get started.

With strong technical expertise, Usman has also developed a wide range of trading tools—custom forex robots for MT4, MT5, and cTrader, as well as Python-powered trading applications that integrate multi-timeframe logic, indicator overlays, and real-time data feeds.

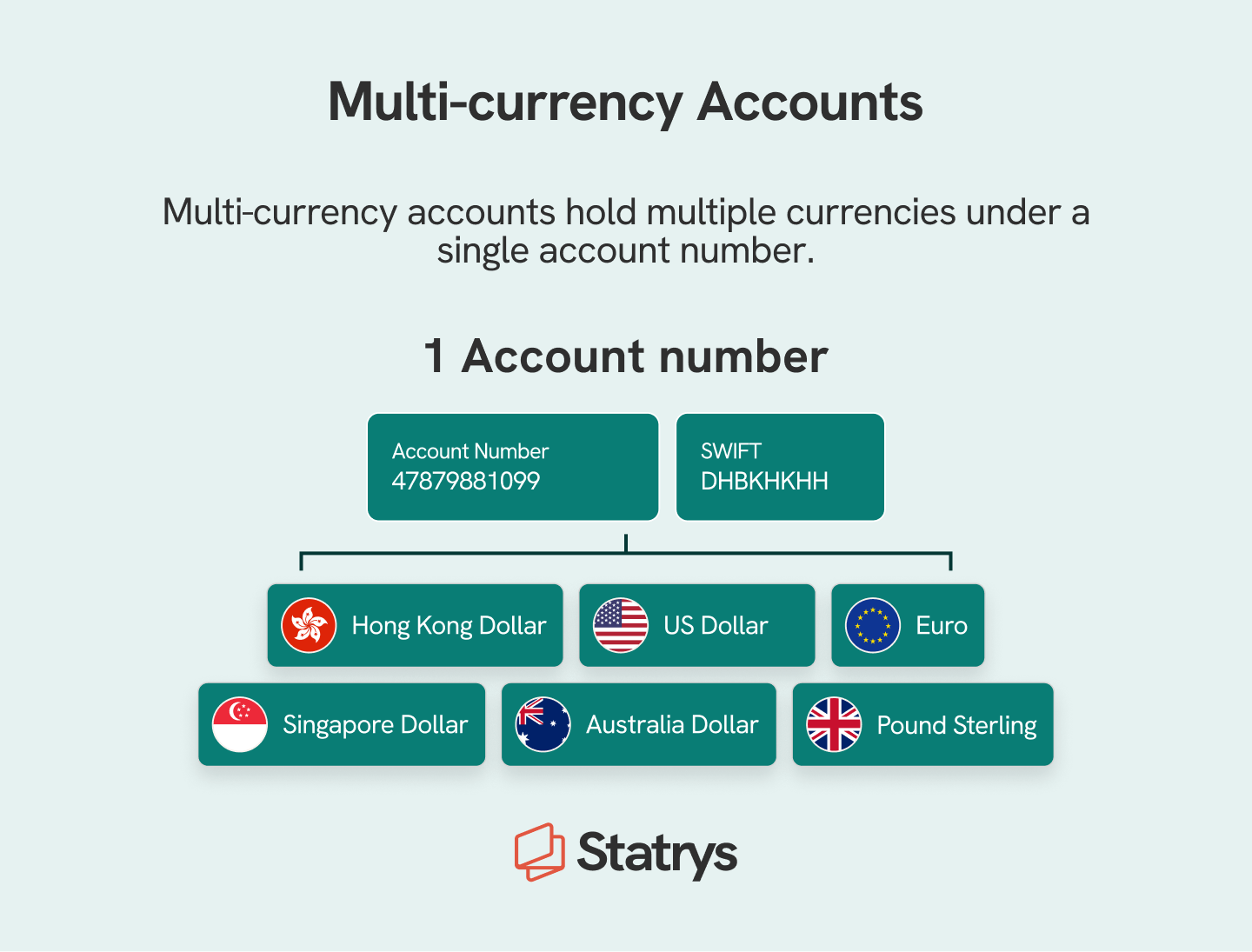

Multi-currency trading account

The account offers a free, multicurrency debit card with no fees for overseas spending or cash withdrawals (£500 per day limit on withdrawals). The card can be added to your digital wallet (or Apple Pay, Google Pay). This is not a prepaid travel card, but a bank debit card linked to your account.

It is important to note that not all multicurrency account providers are banks. Account holders only have full protection up to £85,000 on their deposits through the Financial Services Compensation Scheme (FSCS) for money held with fully regulated banks. Providers that are not banks cannot offer this protection and guaratee in the event they go bust.

For those who meet the criteria, the account has no annual or monthly fee and comes with an instant access pot, which gives you the flexibility to make money transfers and withdraw funds at any time. Plus there are fixed rate savings on offer, over either three, six, nine or 12 months – so currency you don’t need in the short term can earn interest. Savings interest rates vary depending on the currency you want to hold.

Customers can convert between different currencies in their Wise account, this uses the mid-market exchange rate with no markup. You’ll just pay a currency conversion fee which varies by currency, but typically might be about 0.40% of the value of the transaction for example.

All companies in our listings are authorised and regulated by the Financial Conduct Authority as payment services providers. However, as some of these companies are not banks it means customers’ money with these providers is not protected under the Financial Services Compensation Scheme (more on this in our pros and cons section above).

The alternative to a bank’s multicurrency account is to open a currency account with a fintech company, such as Wise and Revolut. Revolut was granted a banking licence in 2024, but the full process is ongoing and customers (as of November 2024) do not yet have FSCS protection for their money.

Training in the basics of trading

Overall, the PDT rule is designed to protect traders by limiting their risk exposure and ensuring that they have enough capital to cover potential losses. Traders need to understand the PDT rule and its implications before engaging in day trading activities.

When you trade, you’ll use a platform like ours to access these markets and take a position on whether you think a market’s price will rise or fall. If your prediction is correct, you’ll make a profit. If incorrect, you’ll incur a loss.

Skills you’ll gain: Financial Market, Capital Markets, Portfolio Management, Investments, Market Dynamics, Equities, Financial Policy, Economics, Banking, Asset Management, Risk Management, Financial Analysis

Bid and Ask: The bid price is the highest amount a buyer is willing to pay for a financial asset, while the ask price is the lowest amount a seller is willing to accept. The difference between the bid and ask prices is called the spread. A successful day trader will aim to capitalize on the fluctuations in the bid-ask spread to make profits.

If a trader executes more than three day trades within five business days and does not meet the minimum equity requirement, their account may be restricted from day trading until the minimum equity requirement is met. It’s important to note that the PDT rule only applies to margin accounts, not cash accounts.